Welcome to a new week my fellow traders!

As I begin my week reflecting on my trades for the past weeks, I also reflect on what turned out to be a very peaceful view from my office this week. I must commend Cairo on their exceptionally calm and peaceful protests the past two Fridays! What I was anticipating to be a large and potentially violent demonstration, actually turned out to be a few thousand protesters voicing their views, in what resulted in a relatively peaceful gathering (photo below taken from the balcony of our building). According to The Egyptian Gazette, only 8 people were killed in clashes Friday week, across the whole of Egypt. This is a huge improvement from the 1,000+ who have sadly lost their lives over the past few weeks, and many of these have unfortunately been in our “front yard” ![]()

Regrettably over the past week, the emphasis appears to have bypassed protests and moved on to disruptions through bombings. The Egyptian Interior Minister was very lucky to survive an assassination bid last week after a bomb was detonated near his house in Nasr City, Cairo. Although I never heard, nor personally saw the devastation after this blast, Nasr City is our neighbourhood – this is all just a little bit too close for comfort! Sadly, reports were that 2 people died and 24 were injured in this attack.

Regrettably over the past week, the emphasis appears to have bypassed protests and moved on to disruptions through bombings. The Egyptian Interior Minister was very lucky to survive an assassination bid last week after a bomb was detonated near his house in Nasr City, Cairo. Although I never heard, nor personally saw the devastation after this blast, Nasr City is our neighbourhood – this is all just a little bit too close for comfort! Sadly, reports were that 2 people died and 24 were injured in this attack.

I hope to be able to report on some brighter news from my neighbourhood next week ![]()

Enough of what’s been happening around “my office”, let’s get down to business and discuss the results from within my trading office…

The two trades I had my eye on in my previous post were the AUDJPY and EURUSD. I took both the trades (based on the reasoning discussed in my post). This was the outcome…

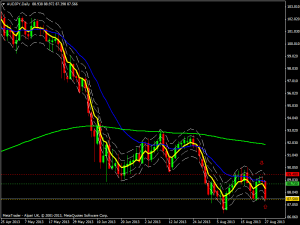

AUDJPY

I set the order to short this pair at 88.71, just prior to going to bed. This is the perfect time to set an order for an “end of day” trade, since the daily candle had just closed in London. My technical analysis was telling me sell the AUDJPY, with the indications being that this was a high probability set up. My order was triggered the next day, and my predetermined target was subsequently hit on day 2. 121 pips profit (over a week’s worth of profit) achieved in 2 days from one order that I set and left. This little gem of a strategy is perfect for those of you who are too busy to be checking computer screens all day and/or who work full time. About 15 mins work analysing and setting the order for this pair, which resulted in a week’s worth of profit! Brings new meaning to the “4 Hour Work Week”

I set the order to short this pair at 88.71, just prior to going to bed. This is the perfect time to set an order for an “end of day” trade, since the daily candle had just closed in London. My technical analysis was telling me sell the AUDJPY, with the indications being that this was a high probability set up. My order was triggered the next day, and my predetermined target was subsequently hit on day 2. 121 pips profit (over a week’s worth of profit) achieved in 2 days from one order that I set and left. This little gem of a strategy is perfect for those of you who are too busy to be checking computer screens all day and/or who work full time. About 15 mins work analysing and setting the order for this pair, which resulted in a week’s worth of profit! Brings new meaning to the “4 Hour Work Week” ![]()

EURUSD

The second trade I took that week was the EURUSD, for the aforementioned reasons in my previous post. This was a trade which didn’t go according to my plan. Oh well, you can’t win them all, and especially when it comes to Forex! Losing is part and parcel of trading and should always be factored into your strategy. The idea is to try and ensure that your winning trades reward you with at least double what your losing trades take away from you.

Thank God I had my stop loss in place! If not, I could have been in a much worse position (as indicated by the last candle). A stop loss is mandatory in every single one of my trades and this has ended up saving my butt many a time. It’s there to save your butt also – make sure you utilise it!!

Thank God I had my stop loss in place! If not, I could have been in a much worse position (as indicated by the last candle). A stop loss is mandatory in every single one of my trades and this has ended up saving my butt many a time. It’s there to save your butt also – make sure you utilise it!!

The up arrow indicates where I entered the trade (at the green dashed line) – after the pullback to the break of the triangle. The down arrow is where my stop loss safely got me out of the trade (red dashed line), before I potentially could have ended up losing my shirt on the next candle. The gold dashed line was my predetermined target. I entered Long at 1.3391 and was stopped out at 1.3350 = 41 pips loss

Overall, at the end of the 30 August trading week, my total profit was 80 pips. Not bad, considering this was realised only from two trades.

With the threat of a strategic strike on Syria, Non Farm Payroll, interest rate news and numerous other “red flag” news announcements, I chose to take a voluntary week off last week. Sometimes the best trade is no trade at all. It is a good idea to be well aware of when these important news announcements occur and to sit on your hands if need be during these times. A great website which details all economic news and exactly when these news announcements are due out is: http://www.forexfactory.com/ Checking this website should form a part of your daily trade planning strategy. It’s an excellent resource – use it!

Bring on the 4 Hour (or less) Work Week this week…

Happy trading!

Jackie