I hope you took advice from my warning last week regarding the non-farm payroll news announcement and stayed out of trades until after this news came out. Since technical areas certainly weren’t being respected after this news announcement! Technically the EURUSD was at a level early last week where price logically should have reacted and bounced back down. This was explained in detail in my previous blog post. However, as soon as the worse than expected US jobs news came out, price skyrocketed and powered straight through our important resistance level at 1.3715. Based on this NFP news coming out, I did not enter the USDCHF trade long, as I was planning, and instead was waiting until after the news announcement. Being cautious saved my butt in this case! Like the EURUSD, after the news came out price powered straight through our strong support/resistance level.

I hope you were cautious also and didn’t let NFP spoil your week last week ![]()

Let’s take a look at our trading week ahead for this week…

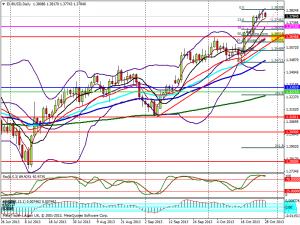

EURUSD

Long @ 1.3640

I am not interested to long the EURUSD at it’s current price. I expect there will be some profit taking on this pair after it’s recent move up last week, and MACD divergence is in play also. If price gets back down to 1.3640 I will however be looking to take a long – for multiple reasons… This level is 50% fib, intersection of trendline and support & resistance line.

I am not interested to long the EURUSD at it’s current price. I expect there will be some profit taking on this pair after it’s recent move up last week, and MACD divergence is in play also. If price gets back down to 1.3640 I will however be looking to take a long – for multiple reasons… This level is 50% fib, intersection of trendline and support & resistance line.

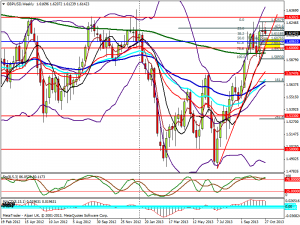

GBPUSD

Long @ 1.6070, or if fails here then

Long @ 1.6000

Fundamentally this pair is looking healthier than the EURUSD and technically it looks bullish also. I will be looking to long at the 1.6070 area which is 50% fib, weekly trendline and the monthly 55 ema is just below also, ie. multiple reasons. If price fails at this level, then I will definitely be looking to long at 1.6000.

Fundamentally this pair is looking healthier than the EURUSD and technically it looks bullish also. I will be looking to long at the 1.6070 area which is 50% fib, weekly trendline and the monthly 55 ema is just below also, ie. multiple reasons. If price fails at this level, then I will definitely be looking to long at 1.6000.

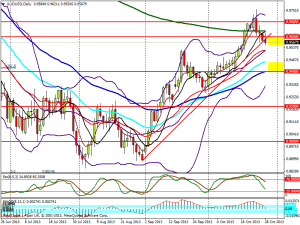

AUDUSD

Short @ .9600

Long @ .9400

MACD divergence is indicating that this pair is in for a fall. Price has also closed below the daily trendline, 200ema and also the whole number of .9600. I will wait for a pullback to .9600 on the daily before entering the trade short.

MACD divergence is indicating that this pair is in for a fall. Price has also closed below the daily trendline, 200ema and also the whole number of .9600. I will wait for a pullback to .9600 on the daily before entering the trade short.

The next area I will be looking to trade on this pair will be to long at .9400. This is previous support, it is an important whole number and it also intersects with the 55ema.

USDJPY

Weekly – Triangle Break

I am still watching this pair for a potential triangle break, which could potentially reward us with a 1,000 pip move. This was discussed in last week’s post. Patiently watching and waiting…

I would love to hear from you! If you have any comments, suggestions or want help with anything, please let me know.

Happy trading!

Jackie